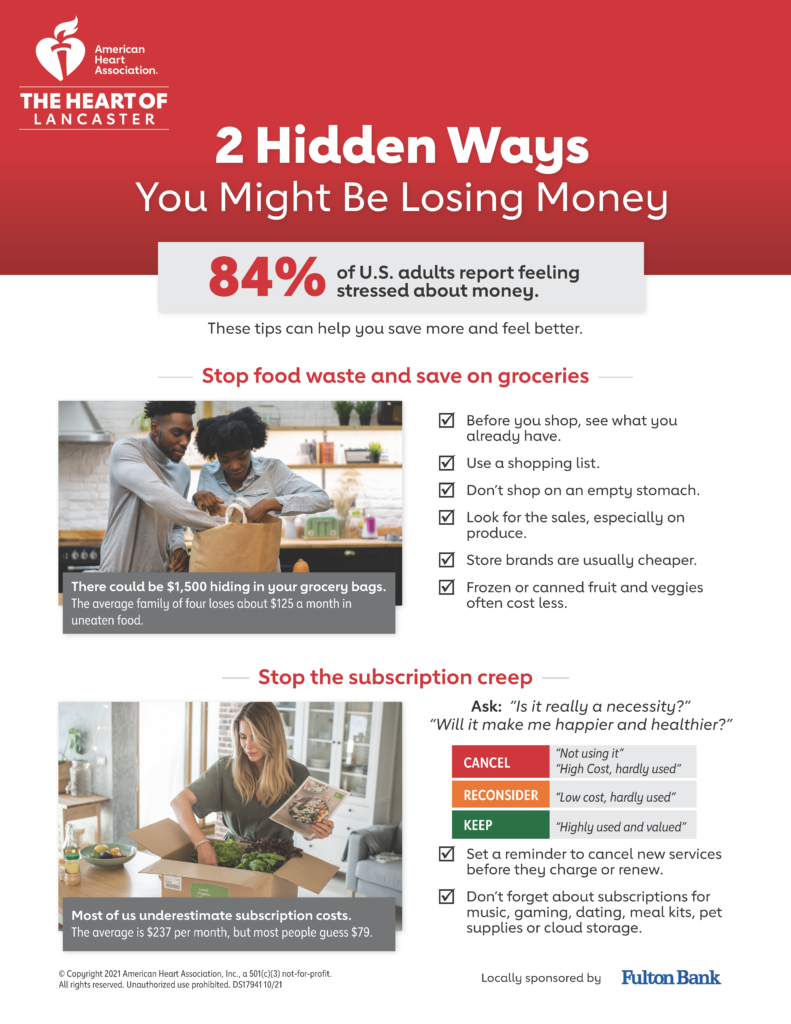

Money is a top source of stress for Americans of all economic backgrounds. In one survey, 84% of adults reported feeling stressed about money.

The bad news? All that stress is taking a major toll on our bodies AND minds. Long-term stress is linked to migraines and sleep problems and can even contribute to chronic health issues like diabetes and heart disease.

The good news? You can relieve some of that stress by gaining control over your expenses.

“To eliminate stress, you must stop spending on things you don’t care about and start saving money for what really matters,” said Mark Katkovcin, consumer sales manager at Fulton Bank in Lancaster, Pennsylvania. “Two areas where we see clients spending more than they need is at the grocery store and on subscriptions. With just a little planning, you can take some of that money and put it toward a nest egg and some financial peace of mind.”

What’s hiding in your grocery bags?

What if you heard there was $1,500 in your grocery bags? Would you look?

Well, ⅓ of all food in the US goes uneaten through loss or waste. And that adds up! For the average family of four, that’s $125 wasted every month.

It can be easy to autopilot your way through a trip to the market. But using just one of these tips can save you money every time you go.

- Before you shop, see what you already have

- Use a shopping list (bonus points if you meal plan a bit)

- Don’t shop on an empty stomach

- Look for the sales, especially on produce

- Store brands are usually cheaper

- Frozen/canned fruit and vegetables often cost less

Subscription Creep

How many subscriptions do you think you have? Two? Four?

In a 2018 survey, people were asked how much they spend on their monthly subscriptions. 84% of them grossly underestimated. They initially guessed around $79, but the actual average was $237!

Subscription creep happens so easily — especially when each one seems “cheap” per month and we can get free trials in just a few clicks.

We remember subscriptions like the internet, cell phone and streaming TV. But others like music, gaming, dating, meal kits, pet supplies, razors, cloud storage, identity theft protection and gym membership can be easy to forget. And it all adds up!

It’s time to reclaim control over your subscriptions:

- Make a list of ALL your subscriptions. Don’t forget ones that only charge once a year.

- Think about the subscriptions in terms of use and necessity:

- Not using it: cancel

- High cost, hardly used: cancel

- Low cost, hardly used: consider canceling

- Highly used and valued: keep

- Limit subscriptions to one per category. You can switch services when you’re ready for something new.

- Set a reminder to cancel new services before they charge or renew.

Thank you to Fulton Bank for helping us share these tips to improve financial wellness and reduce stress as part of our Heart of Lancaster campaign.